Whether you’re a government agency collecting official tax forms or an accountant gathering information from your clients, securely receive tax information online with Jotform’s Tax Forms! Start by selecting a form template below and customizing it to match your needs and branding.

Customer Satisfaction Evaluation Forms 29.Pet Adoption Application Form Templates 47.Membership Application Form Templates 63.Internship Application Form Templates 17.

Workshop Registration Form Templates 86. Patient Registration Form Templates 142. Fully customize this form and add more information by using the Form Builder. This template also uses the Form Calculation widget in order to get the total expenses by adding the amount of each expense in the table. This form template is using the Input Table tool to display the fields in a table format. This form template is utilizing the Section Collapse tool in order to separate each section of the form and improves the user experience for the respondent. This form can also be used as a guideline or proof when filing for a tax return on a yearly basis.This Tax Preparation Client Intake Form contains form fields that ask for filing status, taxpayer information, spouse information, dependents, expenses, tax-related questions, acknowledgment, and signature. This intake form contains a series of questions that will identify the tax amount to know if there are any overpaid taxes. Tax Preparation Client Intake Form is a tool that a taxpayer can use to verify his/her income, expenses, insurance, and other related information about tax for the current year. Furthermore, you need an SSN or ITIN to file Form 1040-V.Preview Tax Preparation Client Intake Form If you send the IRS a check along with a Form 1040-V without a return having been filed, your check will get thrown into a pile of “weird stuff that we have to figure out what to do with” and will get processed days or even weeks later, and you may be liable for penalties and interest if the delay in processing results in your account being credited after the date on which payment was required. Form 1040-V is only used when you submit a payment by check either at the same time you file an individual return or after you have filed an individual return. Individual Income Tax ReturnDo not use Form 1040-V.

Workshop Registration Form Templates 86. Patient Registration Form Templates 142. Fully customize this form and add more information by using the Form Builder. This template also uses the Form Calculation widget in order to get the total expenses by adding the amount of each expense in the table. This form template is using the Input Table tool to display the fields in a table format. This form template is utilizing the Section Collapse tool in order to separate each section of the form and improves the user experience for the respondent. This form can also be used as a guideline or proof when filing for a tax return on a yearly basis.This Tax Preparation Client Intake Form contains form fields that ask for filing status, taxpayer information, spouse information, dependents, expenses, tax-related questions, acknowledgment, and signature. This intake form contains a series of questions that will identify the tax amount to know if there are any overpaid taxes. Tax Preparation Client Intake Form is a tool that a taxpayer can use to verify his/her income, expenses, insurance, and other related information about tax for the current year. Furthermore, you need an SSN or ITIN to file Form 1040-V.Preview Tax Preparation Client Intake Form If you send the IRS a check along with a Form 1040-V without a return having been filed, your check will get thrown into a pile of “weird stuff that we have to figure out what to do with” and will get processed days or even weeks later, and you may be liable for penalties and interest if the delay in processing results in your account being credited after the date on which payment was required. Form 1040-V is only used when you submit a payment by check either at the same time you file an individual return or after you have filed an individual return. Individual Income Tax ReturnDo not use Form 1040-V.

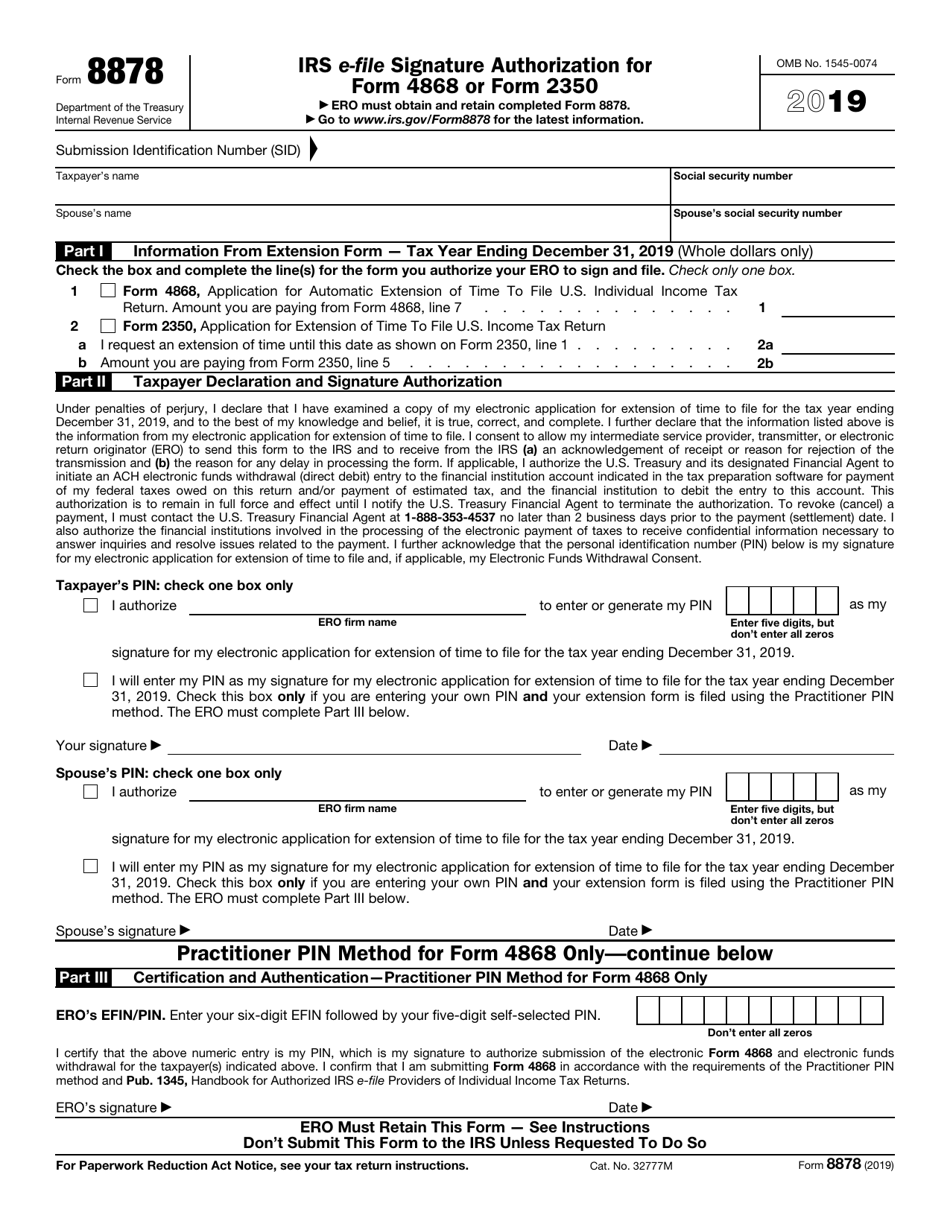

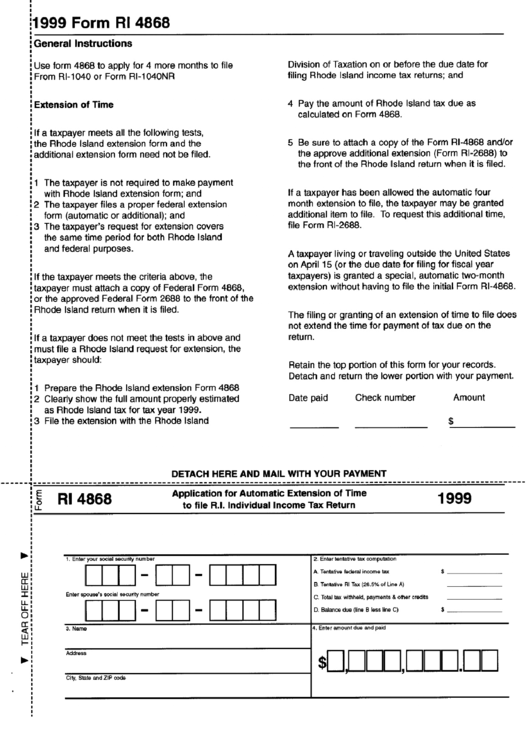

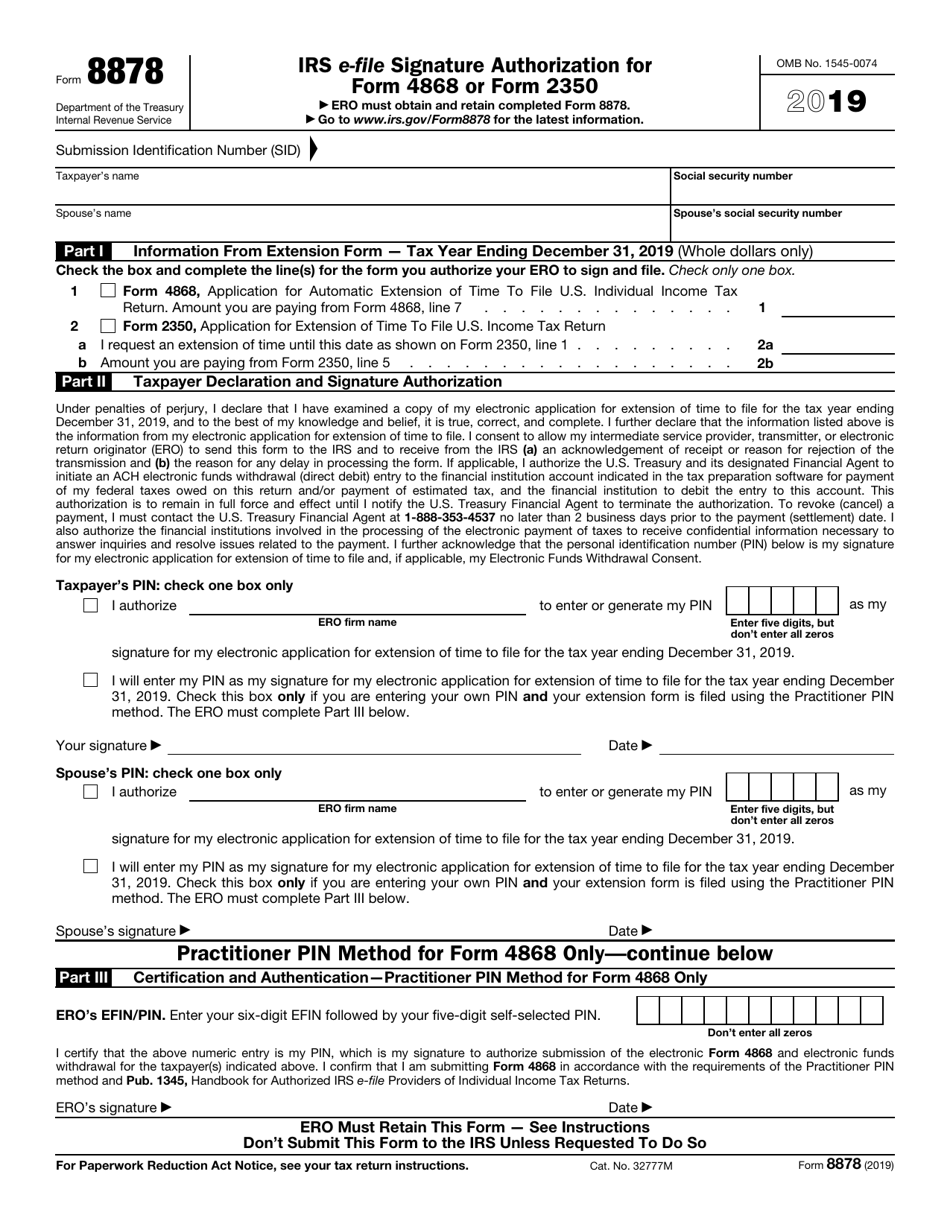

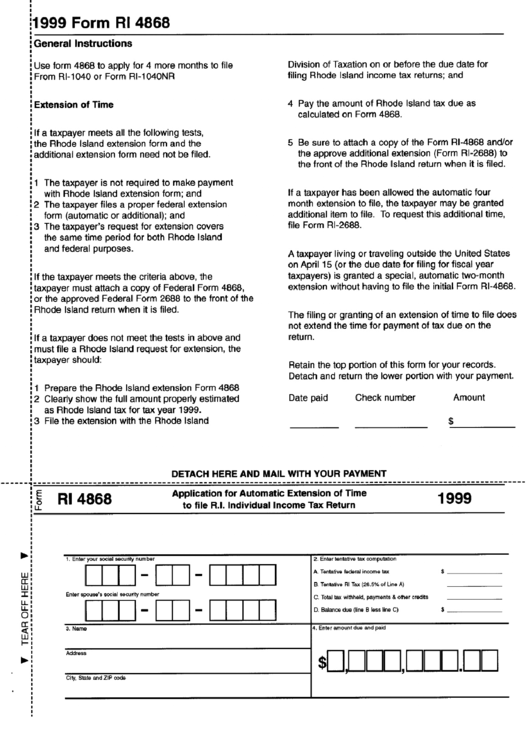

All of the other available methods for making a prepayment of tax liability require an SSN or ITIN.Form 4868, Application for Automatic Extension of Time To File U.S. If you do not have your ITIN in time to file your return on time, your only option is to file Form 4868, along with a payment of your estimated tax liability. You do not need an ITIN to file Form 4868, and you can include a payment with Form 4868. If you anticipate that you will not be able to file your return by its due date, you need to file Form 4868 to request an extension.

0 kommentar(er)

0 kommentar(er)